Hello and Good Morning. It's Saturday and Sounds of the Sixties is just finishing, so I'll turn the radio off because it's a distraction. No point in leaving it on if I am not listening to it.

This post has connections with the 'No Quick Fix' theme of yesterday. All will become clear if you read on. Below I have copied a letter I received from my bank, dated 6th June 2008, yes I keep all my banking correspondence filed away for future reference. If you want to read it you might have to magnify it, but the gist of it is that they are offering me a Personal Reserve fund, an amount of money that I can use if I have exhausted my balance and my overdraft. I have never had an overdraft, by the way. When there is no money left, this Reserve Fund kicks in. Well isn't that nice of them!

The letter states that the Personal Reserve is help when I need it most, so nothing to worry about then. When I am absolutely skint there will be money in the pot to enable me to carry on spending. Such a comfort to know this. But hang on a minute, there has to be a catch, there usually is. If I go into the reserve I have to pay a fee of £22 for the first five consecutive working days, and if I am still using the reserve there will be a further fee to pay of £22 for each subsequent five working day period, regardless of the number of transactions in that period. Now for someone who sees the word 'interest' as a dirty word, that arrangement sounds horrific.

This letter arrived at about the same time as I was reducing my working hours which reduced my pay. My bank balance was slowly shrinking, almost to the point of dropping below the bottom line. It never did though, I always pulled myself back up again.

Of course there are a couple of other niggly charges that they can add on as well. Returned transaction fee £8 per transaction, and Guaranteed transaction fee, £8 per transaction. So if you take your eye off the ball and slip up it will cost more, which is what happens normally if you overspend or make a mistake with transaction dates.

Did I sign up for this fantastic offer? What do you think? Nope, I wrote and declined it. If you have been reading my blog long enough you will know that I don't spend more than what I have coming in. Below is a little snippet from the top of my monthly statement. Emergency Borrowing NIL. You can see that they have thrown a tempting morsel my way of a personal loan of £20,300. They don't give up do they.

Right, what you see here is how much credit I can have with my one credit card. I could have a nice treat with that, but, and here's the catch, the same rules apply to the reserve fund and the overdraft, IT ISN'T MY MONEY. A lot of people would look at that and think, let's spend it, I deserve a holiday. Not a good idea, because it has to be paid back with that dirty word, interest.

Every time I use my credit card, I have the funds in my bank account to pay it off. I use it for convenience, and for the consumer protection it gives me on larger purchases that might go wrong, and it gives me points. I put part of my car payment on this to help rack up the points. All of my small purchases I pay for with cash. It's very rare I use a card in the discount stores.

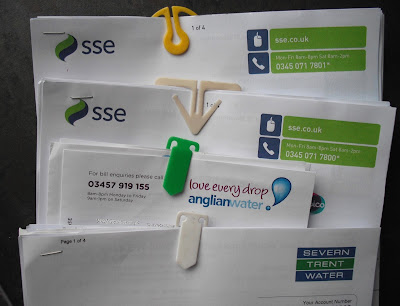

Now I need to make the connection with what I have written here, to 'No Quick Fix' There are thousands of people with lots of small debts spread around lots of companies. Lots of bits of paper coming through the post, asking for payment. Lots of bits of paper getting lost, shoved in a drawer, and ignored. It's called burying the head in the sand, I'll sort it one day. Keeping track can make it very difficult to balance money coming in with money coming out.

Wouldn't it be much easier to have one payment going out to cover all the bills? Debt consolidation sounds like a good idea, get a loan and repay all the debts with it, then there is only the loan to pay off every month. Simple. Sounds like a good quick fix to me, or does it?

A loan does not get rid of the debts, it just moves them to a different place. Get the loan, pay off the cards, and bingo. The cards are cleared, the catalogues are cleared, the payday loans are cleared, the overdraft is cleared, giving you a fresh new start. But it isn't. What happens if an unexpected expense occurs, something breaks and has to be replaced, or the holiday of a lifetime opportunity is too good to turn down, or a wedding is planned, or even a night out on the town with your mates is on for next week? That's OK, you still have the cards to pay for it. And so the downward spiral starts again.

Moving debts onto a consolidation loan is a quick fix which is not going to work, if you haven't learnt any lessons. If your attitude to spending has not changed, you will find yourself back at square one, with even more debt. It is all over Money Saving Expert Forum that it is not a good idea to move debt around, with the one exception of moving some of it to a 0% interest card, and even then, that 0% is only going to last for a year or so. If you have not paid off that card before the time runs out you will find yourself with even more of that dirty word, interest, to pay.

Forget quick fixes for sorting out debt, the remedy needs to be long term. There is a

Statement of Affairs calculator on MSE where you list all your incomings and outgoings. Fill that out to get a better picture of where you're at.

It's not rocket science, changing your mindset about how you spend over the long term is the key. You don't lose weight by a frenzied stopping eating over a couple of months because it will pile back on again, and you don't get out of debt by juggling it around and shifting it to different places, it's still there.

Grey skies today, I won't be going far.

Thank you for popping in. I hope you have a good weekend. Catch up soon.

Toodle pip